The Independent Petroleum Producers Group (IPPG) has urged the Federal Government to reconsider its decision to sell crude oil to local refineries in naira.

IPPG said the decision will worsen Nigeria’s currency volatility and foreign exchange receipts.

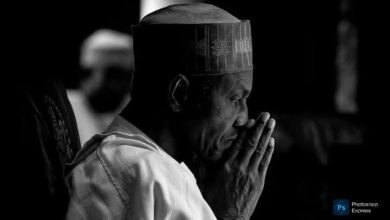

In a statement released by Abdulrazak Isa, Chairman of IPPG, he expressed concern in a letter addressed to Gbenga Komolafe, Chief Executive Officer (CEO), the Nigerian Upstream Petroleum Regulatory Commission (NUPRC).

Last month, the Federal Executive Council (FEC) approved a proposal by President Bola Tinubu directing the Nigerian National Petroleum Company (NNPC) Limited to sell crude oil to the Dangote Petroleum Refinery and other refineries in naira.

Speaking on the issue, Isa said such a move is against the law.

He said a significant source of the government’s royalty and taxation earnings, such as petroleum profit tax (PPT), company income tax (CIT), and hydrocarbon tax (HT), which are denominated in dollars, would be affected, and could further disrupt the fiscal regime.

“We are (also) aware of suggestions and proposal to sell crude in Naira, this is inconsistent with the law and will further put a materially significant strain on the efforts of the Government to manage the Naira as it will reduce Nigeria’s FX receipts from its highest FX revenue earner – the oil and gas industry, which is a significant source of the Nigerian Government’s royalty and income taxes earnings (PPT, CIT and HT) that are denominated in US Dollars”, Isa said.

The IPPG chair also expressed concerns over recent industry developments, including NUPRC’s domestic crude oil refining requirements and production forecast for 2024, and the request for monthly quotations for local refineries.

“However, it is important to highlight certain contractual, legal, financial and factual incongruencies that exist in the increasing push and demands on petroleum producers and particularly on members of the IPPG,” he said.

“We are indeed constrained to say that the current position on this matter may inevitably lead to economic damage and self-sabotage of the Nigerian economy. This is simply an inescapable fact.’’

Citing a potential economic emergency, Isa said he is aware that the group’s members are mandated to allocate crude volumes to the domestic market for the second half of 2024, in line with the NUPRC’s domestic crude oil supply obligations (DCSO) guideline.

Isa said under Nigerian law, “any supply of crude oil to a refinery even under a DCSO umbrella is required to be on a willing buyer and willing seller basis”.

“This is the position of the principal law that cannot be derogated by regulation or guideline,” he said.

“Additionally, all producers (including NNPC Limited) are currently beholden to either fixed supply contracts or forward sale contracts to international traders who have stepped in to fill the financing gap to fund upstream investments since international finance institutions have reduced their funding positions to fossil fuels due mainly to ESG requirements.

“These contractual arrangements have become the necessary collateral obligations for producers (including NNPC Limited) and thus they currently have contractual rights to producers’ barrels of crude oil.

“In addition, crude cargoes are normally sold at least three (3) months in advance and therefore your recent letters to some of our members received in August mandating DCSO volumes from July to December 2024 are not achievable, particularly as most, if not all, of the cargoes from July to October will already have been sold.’’