Nigeria has nothing to show for collecting over 60 taxes, levies – Oyedele

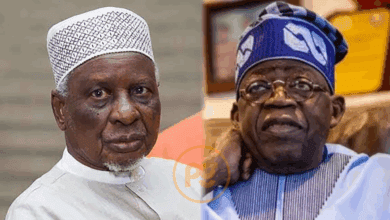

Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has claimed that the Federal Government has nothing to show for more than 60 taxes and levies collected across the country.

He said this at the Senate’s plenary on Wednesday.

“The fiscal system we have today inhibits growth as more than 60 taxes and levies are collected from across the country but nothing to show for it,” he said.

He further noted that the FG intends to halt the situation where Nigerian businesses are forced to pay tax even in the face of losses, compelling the need to scrutinise the system through key reforms.

“We do not want to tax capital or poverty but investment. We are beginning to lose our tax base to other countries. This is why it is urgent to reform the tax system,” he added.

At the end of the explanations, the lawmakers declined to ask questions, resolving to invite the team on the next legislative date to clarify aspects of the proposed reforms before a final resolution is taken.

Oyedele’s allegation followed the Senate’s Wednesday protest over the entry of the Federal Inland Revenue Service (FIRS) Chair, Zacch Adedeji and consultants to the Upper Chamber.

The lawmakers suspended its rules to admit Adedeji and the consultants to explain what the Tax Reform Bill entailed.

However, before they were admitted, a slight uproar ensued as some lawmakers kicked against the FIRS Chair’s entry to the chamber.

Oyedele is leading the charge for the controversial proposed Fiscal Policy and Tax Reform Bill.

President Tinubu had in October sent the tax reform bill, which he said is align with ongoing financial reforms of the Federal Government and enhance efficiency in tax compliance, to the National Assembly.

Just after the bill was sent to the National Assembly, it starting generating controversies with some Northern leaders calling for its withdrawal.

The governors of the 19 Northern states had rejected the bill, especially the proposed amendment to the distribution of Value Added Tax (VAT) to a derivation-based model.

The National Economic Council (NEC) also expressed reservations over the Tax Reform Bill forwarded by President Bola Tinubu to the National Assembly.

NEC unanimously called for the withdrawal of the bill.

However, the President explained that the bill is not targeted at the 19 northern states, the presidency has said.

According to presidential spokesman, Bayo Onanuga, the new proposal, as enunciated in the bill, is designed to create a fairer system that will benefit all states.

Amid the calls to withdraw the tax reform bills, President Tinubu on November 1, said the document would not be withdrawn from the National Assembly.

He rather explained that the bills should go through the legislative process.

President Bola Tinubu “received the National Economic Council’s recommendation that the tax reform bills already sent to the National Assembly be withdrawn for further consultation,” a statement signed by Onanuga said.

“He believes that the legislative process, which has already begun, provides an opportunity for inputs and necessary changes without withdrawing the bills from the National Assembly.

“While urging the NEC to allow the process to take its full course, President Tinubu welcomes further consultations and engagement with key stakeholders to address any reservations about the bills while the National Assembly considers them for passage.

“When President Tinubu set up the Presidential Committee on Tax and Fiscal Policy Reform in August 2023, he had only one objective: to reposition the economy for better productivity and efficiency and make the operating environment for investment and businesses more conducive. This objective remains more critical even today than ever before,” the statement read.