Controversy over tax reform bills continues as Reps engage in rowdy session

The last of the controversy surrounding President Bola Tinubu’s tax reform bills has not been heard after the House of Representatives was thrown into a rowdy session on Tuesday during plenary.

Spokesperson of the house, Akin Rotimi, had referenced the tax reform bills on the floor of the green chamber which triggered the commotion.

Rotimi had risen to move a motion for the consideration of two reports on behalf of Boma Goodhead, a lawmaker from Rivers State, who was absent at plenary.

The report was on a bill for an act to repeal the Nigerian Oil and Gas Industry Content Act 2010, and enact the Nigerian Oil and Gas Industry Content Act.

“My name is Akin Rotimi Jr. I represent the people of Ekiti north, comprising Ikole and Oye local governments. Mr Speaker, I am from Ekiti state, the first state, whose national assembly caucus, has unanimously endorsed the tax bills,” he said.

Rotimi was still speaking when he was boisterously interrupted by his colleagues.

Tajudeen Abbas, the speaker, who presided over the session, attempted to restore calm, saying Rotimi was expressing his personal opinion.

“He was just talking on a lighter note. Let us not take it seriously,” Abbas said.

The lawmakers remained unappeased, repeatedly shouting, “no, no, no”.

At this point, Rotimi apologised and withdrew his comment on the tax reform bills.

“Mr speaker, I withdraw the introduction. I will introduce myself properly. Mr speaker, can I have the opportunity to speak? Colleagues, I would like to withdraw that introduction and restrict myself to the Order Paper,” Rotimi said.

The speaker responded, advising Rotimi to issues relevant to the subject matter.

“Mr Rotimi, you know this is a controversial issue. I don’t want you to be mentioning things that are not relevant to the subject matter. On your behalf, I withdraw that statement that you have made,” Abbas said.

Rotimi reintroduced the report, but it was not seconded as lawmakers continued to protest, prompting him to withdraw it.

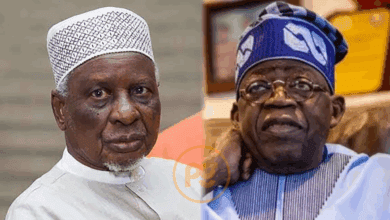

‘He’s not anti-north’ — Dogara tells northerners to stop condemning Tinubu over tax bills

Yakubu Dogara, former speaker of the house of representatives, has urged northerners not to condemn President Bola Tinubu over the proposed tax reform bills.

Speaking on Monday during Channels Television’s town hall on tax reform bills, Dogara said Tinubu has done something significant with the proposed bills, adding that he is not anti-north.

“I want to talk to my brothers in the north; I don’t think this is the time for us to begin to condemn the president and to begin to say that on account of these bills, he is anti-north,” he said.

“I want to remind us that the president has done something that is significant and if he can pursue this to the end, it will be that there is no northern leader of my lifetime that has done what the president has done for the north.”

Dogara advised that they view the reforms as an opportunity rather than a disadvantage, particularly the creation of the ministry of livestock development.

He highlighted the ministry’s potential to unlock vast economic opportunities for the region, adding that the north can survive on its own without value-added tax (VAT).

“The creation of the livestock ministry is the global business around that; the global market size of dairies, of beef. In the next three years, we will rise to about $2.5 trillion,” Dogara said.

“So if in the north, we are able to organise ourselves in such a way that we can honour just 5 percent of this global market size of diaries and beef, I tell you, that gives us $250 billion.

“We don’t need VAT from any state in Nigeria to survive. The North can survive on its own. We are the most endowed part of Nigeria and don’t joke about it.

“If you are in doubt, find out from Australia how much they are raking from just mining minerals. There’s gold everywhere in the north. We have all the resources. We can survive.”