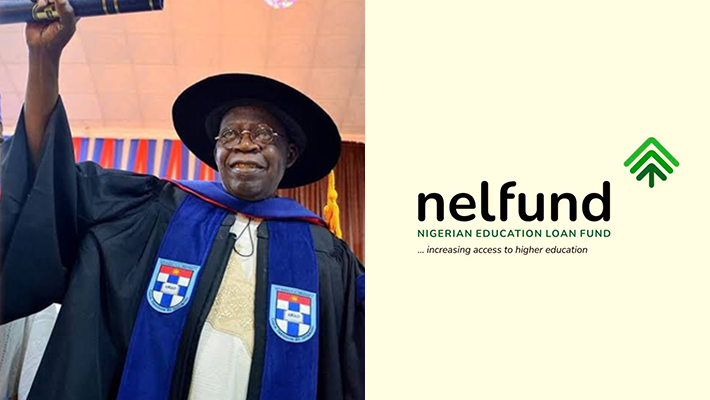

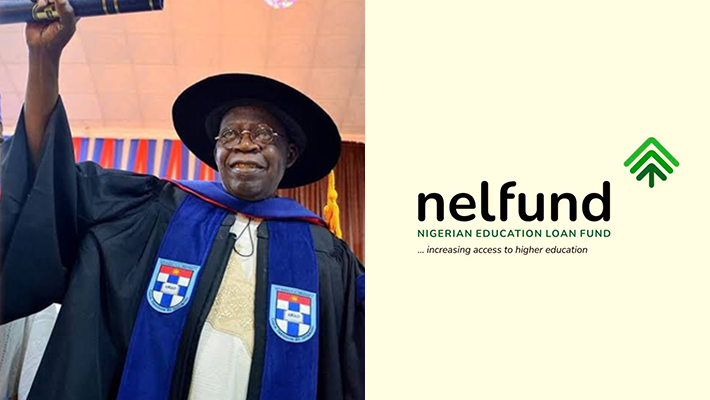

NELFUND to commence student loan scheme disbursement next week

The Nigerian Education Loan Fund (NELFUND), has announced that tertiary institution students who are starting fresh academic sessions and have successfully applied for the loan scheme will begin to receive credit alerts from next week.

This was announced on Wednesday, by NELFUND Managing Director, Akintunde Sawyerr, said on Channels Television’s Politics Today.

“The people who are going to first receive alerts as early as next week are the people who are about to start a new session in the institution they are in”, he said.

Sawyerr noted that other successful applicants will not begin to receive credit alerts until the commencement of academic sessions in their respective institutions.

The NELFUND boss’ comment came hours after President Bola Tinubu launched the Nigerian Education Loan Fund (NELFUND) at the State House in Abuja.

He said 170,000 applicants from universities, polytechnics and colleges of education now have accounts with NELFUND but 110,000 applicants have completed the process.

The NELFUND boss said there are two types of beneficiaries – the first being the institutions that would get paid on behalf of those who have successfully applied to go to those institutions; and the second are the applicants – the students themselves who would receive a monthly stipend.

“A formal launch of the disbursement circle played out at the State House on Wednesday,” he said.

Sawyerr said the programme is aimed at giving Nigeria “better leadership in the future and improve the socio-economic situation of the country”.

“To be precise, about 110,000 students have successfully applied. They’ve put in their applications and verified as being bona fide and eligible applicants. But we’ll still carry out further verification to make sure they are well-qualified to receive these loans. But over 110,000 are likely to begin to receive disbursement from next week”, he said.

“It’s one thing to get approval for the loan, it’s another thing to begin to receive value. This loan is for those who are going to be starting institutions afresh or those who are already there”.

Sawyerr said each of the applicants must have Joint Admissions and Matriculation Board (JAMB) numbers, matric numbers, Bank Verification Numbers (BVN), and National Identification Numbers (NIN), among other requirements.

“Current exposure to students is about N35bn. We’ve got much more than that sitting in our accounts that we can disburse, and we’ve also got some funding on the way. Remember, we are getting 1% of Federal Inland Revenue Service taxes and we also can receive funding from other sources,” the NELFUND MD further explained.